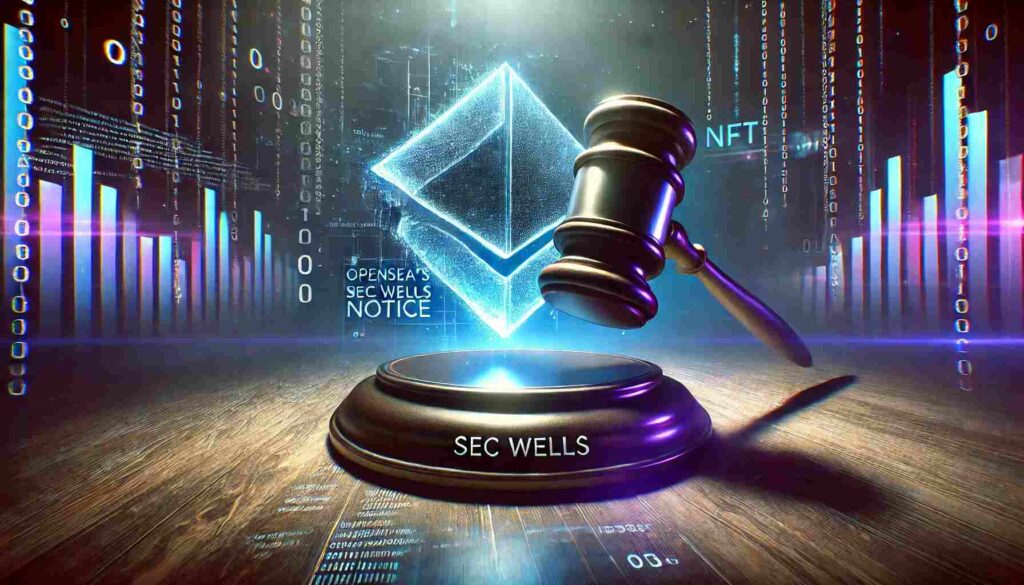

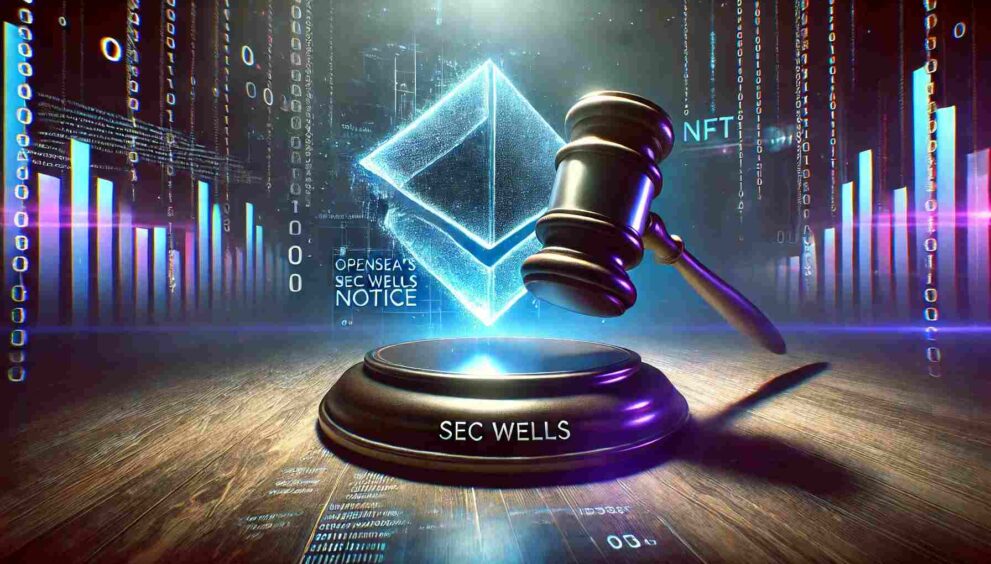

OpenSea’s SEC Wells Notice and the Future of NFTs

The recent Wells notice that OpenSea received from the U.S. Securities and Exchange Commission (SEC) stunned the NFT community. The SEC’s assertion that NFTs traded on OpenSea are securities may greatly impact the future of the NFT market.

The recent Wells notice that OpenSea received from the U.S. Securities and Exchange Commission (SEC) stunned the NFT community. The SEC’s assertion that NFTs traded on OpenSea are securities may greatly impact the future of the NFT market. In this blog post, we will discuss the notice’s contents in detail, look at possible repercussions for OpenSea and the larger NFT ecosystem, and also try to understand whether NFTs should be categorized as securities or not.

SEC’s Wells Notice

Wells notice is a warning given to an individual or company to inform them that the SEC may take legal action against them. The SEC has claimed that the NFTs sold on OpenSea’s platform are called securities. Because of this classification, OpenSea is required to follow strict laws, such as registration and anti-fraud measures.

OpenSea’s Reaction

OpenSea CEO Devin Finzer has strongly refuted the SEC’s claim. He says that NFTs do not fit the conventional definition of securities because they are collectables or art pieces. Finzer has promised to oppose the SEC’s lawsuit and has donated $5 million to help NFTs developers and creators who may face legal action.

Implications for OpenSea and the NFT Market

If the SEC’s lawsuit against OpenSea is successful, the NFT market may have significant consequences. As a result of the SEC’s classification of NFTs as securities, NFT marketplaces and creators will face increased regulatory scrutiny and compliance expenses

Due to this, few inventors and investors are able to join the NFT market, which can hinder its expansion.

On top of that, SEC intervention could also cause confusion and doubt among buyers and sellers of NFTs. If NFTs were categorized as securities, they would be subject to different legal requirements and safeguards than other digital assets. Because of this, it may be difficult for investors to understand and evaluate the risks of NFT investments.

Current Discussion About NFT Securities

The SEC’s action against OpenSea has once again raised the question of whether NFTs should be categorized as securities. There is no agreement on this matter yet, and some people in the NFT community are questioning the SEC’s stance.

Some people believe that there is a fundamental difference between NFTs and conventional securities. He emphasizes that NFTs are unique assets that show ownership of a digital good. In contrast to regular securities, NFTs do not give ownership rights in a firm or its profits.

Some also argue that NFTs can be classified as securities if they meet specific requirements, such as being issued by a joint venture and investors expecting gains that accrue only from the labor of others. This opinion is supported by the SEC’s enforcement actions, such as those pertaining to Impact Theory and Stoner Cats.

In brief

For the NFT industry, the SEC’s Wells notice to OpenSea is a significant development. The case’s outcome may have a big effect on how NFTs, including digital assets, are regulated in the future. Whether or if the SEC’s claim that NFTs are securities remains to be seen. The NFT community will keep a close eye on the issue in the interim.